Tax Avoidance vs Tax Planning: What’s the difference?

Paying taxes is a fact of life, but how much you pay can vary depending on your approach. Tax avoidance and tax planning are two strategies that often get confused, but they’re not the same thing. In this article, we will provide you with an in-depth coverage of tax avoidance vs tax planning. While tax planning is legal, tax avoidance isn’t. The former can save you money, the latter can land you in hot water with the taxman. So, what’s the difference between tax avoidance and tax planning? Let’s find out.

We’ll show you how to legally reduce tax bill while staying on the right side of the tax law. Let’s dive right into it and break down tax avoidance vs tax planning.

What is tax avoidance and how does it differ from tax planning?

Tax avoidance, tax planning, tax evasion – they all sound similar, don’t they? But there are some pretty big differences between them. And if you’re not careful, you could end up in serious hot water with HMRC.

Let’s break it down. Tax avoidance is when you use legal methods to minimize your tax bill. Tax evasion, on the other hand, is when you deliberately and dishonestly avoid paying the tax you owe. And tax planning? That’s the process of organizing your financial affairs in a way that minimizes your tax liability, while still complying with the law.

Understanding the differences between tax avoidance and tax evasion

The line between tax avoidance and tax evasion can be a bit blurry at times. But here’s the key difference: tax avoidance is legal, while tax evasion is not.

Tax avoidance involves using legal tax avoidance schemes and loopholes to reduce your tax bill. This could include things like investing in tax-efficient vehicles like ISAs or pensions, or claiming legitimate business expenses.

Tax evasion, on the other hand, involves deliberately and dishonestly avoiding paying the tax you owe. This could include failing to report income, claiming false expenses, or hiding assets offshore.

The legality of tax avoidance schemes

While tax avoidance is legal, not all tax avoidance schemes are created equal. Some schemes operate in a grey area, and could be challenged by HMRC if they’re deemed to be aggressive or artificial.

In recent years, HMRC has cracked down on what it sees as unacceptable tax avoidance. They’ve introduced measures like the General Anti-Abuse Rule (GAAR) to tackle abusive tax avoidance schemes.

So while tax avoidance is legal, it’s important to tread carefully. Make sure any scheme you use is legitimate and complies with the spirit, as well as the letter, of the law.

Common examples of tax avoidance strategies

There are many legitimate ways to reduce your tax bill through tax planning and tax relief. Here are a few common examples:

- Investing in a pension: Contributions to a pension scheme are tax-free, and can help reduce your overall tax bill.

- Claiming business expenses: If you’re self-employed or run a business, you can claim tax relief on legitimate business expenses like office costs, travel, and equipment.

- Using tax-efficient investment vehicles: Investing in an ISA or Venture Capital Trust (VCT) can help you grow your wealth tax-efficiently.

- Structuring your business tax-efficiently: The way you structure your business (sole trader, partnership, limited company) can have a big impact on your tax bill.

The key is to make sure any tax planning strategies you use are legitimate and above board. If you’re unsure, it’s always best to seek professional advice from a qualified accountant or tax advisor.

The risks and consequences of engaging in tax avoidance

While tax avoidance itself is legal, there are still risks involved. If HMRC deems a scheme to be aggressive or artificial, they may challenge it. And if they’re successful, you could face some serious consequences.

Potential legal and financial repercussions

If HMRC determines that a tax avoidance scheme is not legitimate, they may pursue you for additional taxes, penalties, and interest. In some cases, you could even face criminal charges for tax evasion.

The financial costs can be significant. You may have to pay back all the tax you avoided, plus penalties of up to 100% of the tax due. You could also face additional costs like legal fees and accountancy bills.

It’s not just the immediate financial hit either. Being involved in a tax avoidance scheme can have long-term implications for your credit rating and ability to secure financing in the future.

How HMRC investigates suspected tax avoidance

HMRC takes tax avoidance very seriously. They have a dedicated team – the Fraud Investigation Service (FIS) – that investigates suspected tax fraud and avoidance.

If HMRC suspects you of being involved in a tax avoidance scheme, they may open an inquiry. They’ll request information and documentation from you to assess whether the scheme is legitimate.

HMRC also uses sophisticated data analysis tools to identify suspicious patterns and transactions. They may compare your tax returns to those of similar businesses or individuals to spot discrepancies.

If HMRC determines that a scheme is not legitimate, they’ll issue an assessment for additional taxes, penalties, and interest. In serious cases, they may even pursue criminal charges.

The Impact on Your Personal and Business Reputation

Being involved in a tax avoidance scheme can also have a serious impact on your personal and professional reputation.

If word gets out that you’ve been involved in tax avoidance, it could damage your standing in your industry and community. Customers, clients, and business partners may be reluctant to work with you.

For businesses, the reputational damage can be especially severe. It could lead to negative media coverage, public backlash, and boycotts. In extreme cases, it could even threaten the viability of the business.

The bottom line? While the potential tax savings of avoidance schemes may be tempting, the risks often outweigh the rewards. It’s usually better to play it safe and stick to legitimate tax planning strategies.

Effective tax planning strategies for individuals and businesses

So, if tax avoidance is risky, what’s the alternative? The answer is effective tax planning. By organizing your finances in a tax-efficient way, you can legally reduce your tax bill without falling foul of HMRC.

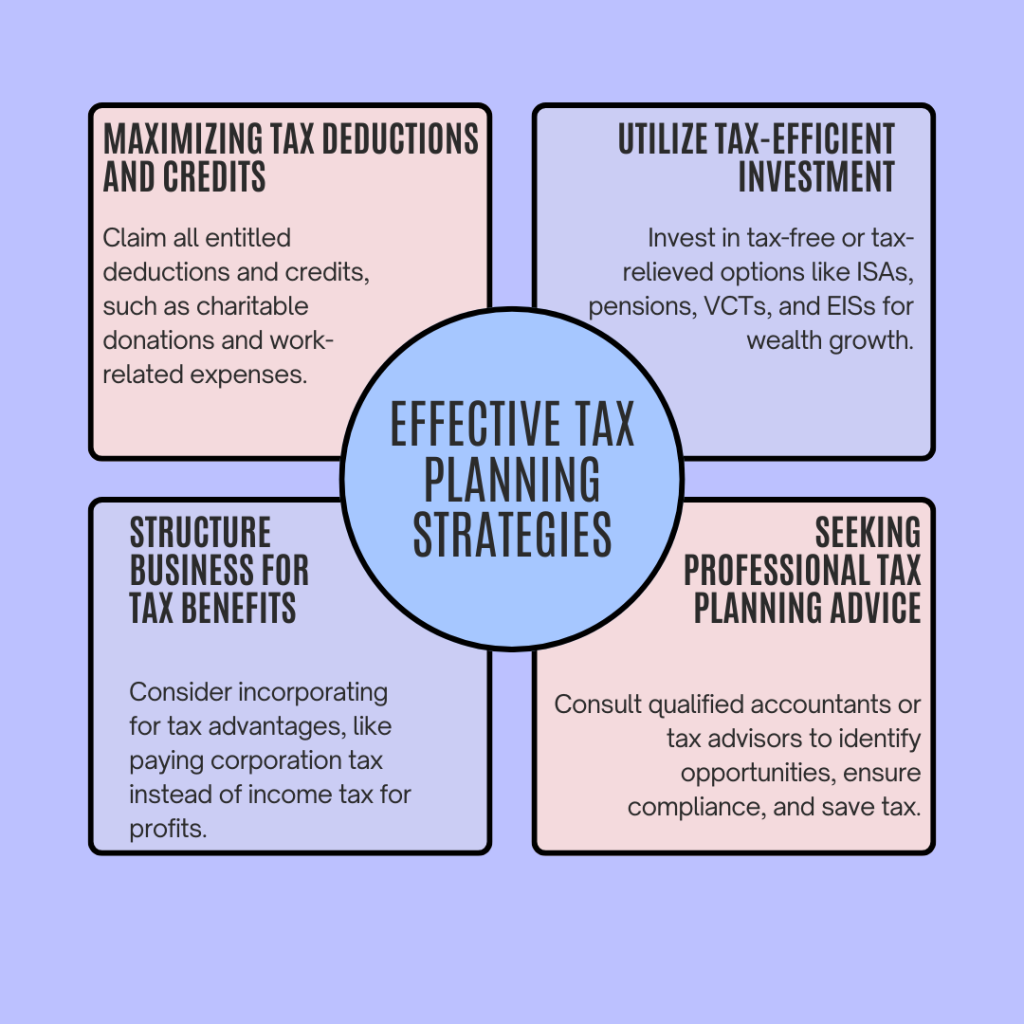

Here are some legitimate tax planning strategies to consider:

Maximizing tax deductions and credits

One of the simplest ways to reduce your tax bill is to make sure you’re claiming all the deductions and credits you’re entitled to. For individuals, this could include things like charitable donations, pension contributions, and work-related expenses.

For businesses, there are a wide range of expenses you can claim, from office costs and travel expenses to staff salaries and equipment. The key is to keep accurate records and make sure any expenses are wholly and exclusively for business purposes.

It’s also worth looking into any tax credits you may be eligible for. For example, the Marriage Allowance lets you transfer part of your personal allowance to your spouse if they earn less than you.

Utilizing tax-efficient investment

Investing your money tax-efficiently can help you grow your wealth while minimizing your tax bill. Some options to consider include:

- ISAs: You can invest up to £20,000 per year in an ISA, and any returns are tax-free.

- Pensions: Contributions to a pension are tax-free, and you’ll only pay tax when you start drawing an income in retirement.

- VCTs and EISs: These schemes offer tax relief on investments in smaller, high-risk companies. They’re not suitable for everyone, but can be a useful tool for experienced investors.

Of course, it’s important to remember that tax efficiency shouldn’t be the only factor in your investment decisions. Make sure any investments align with your overall financial goals and risk tolerance.

Structuring your business for optimal tax benefits

If you run a business, the way you structure it can have a big impact on your tax bill. For example, incorporating as a limited company can offer some tax advantages over being a sole trader.

As a limited company, you’ll pay corporation tax on your profits, rather than income tax. You can also be more flexible with how you take money out of the business, potentially reducing your overall tax bill.

Of course, incorporation isn’t right for everyone. It comes with additional administrative burdens and costs. It’s important to weigh up the pros and cons and seek professional advice before making a decision.

Looking for a corporation tax guide? Fret not, we have got you covered. In this guide we cover all you need to know about corporation tax and more. However, if you’re wondering what are limited company expenses? We have created a detailed guide to provide you with all the information you need.

Seeking professional tax planning advice

Tax planning can be complex, especially if you have multiple income streams or a complicated financial situation. That’s where professional advice can be invaluable.

A qualified accountant or tax advisor can help you identify opportunities to save tax and structure your finances efficiently. They can also make sure you’re complying with all the relevant rules and regulations.

When choosing an advisor, look for someone who is appropriately qualified and experienced. For example, an accountant may be a Chartered Tax Advisor (CTA) or a member of a professional body like the ICAEW or ACCA.

It’s also important to find an advisor who understands your specific circumstances and goals. Look for someone who takes the time to get to know you and your business, and who can offer tailored advice.

Remember, while professional advice may come with a cost, it can more than pay for itself in tax savings and peace of mind. Need reliable and affordable services for your tax compliance requirements? Explore Sleek – a digital platform for SMEs offering trusted solutions for your tax needs and beyond.

Navigating the complexities of tax law and legislation

Tax law and legislation can be a minefield, even for the most experienced professionals. It’s crucial to understand your tax obligations and legal responsibilities, so you don’t fall foul of the rules.

But with tax legislation changing all the time, it can be hard to keep up. That’s where professional advice can be a lifesaver.

Understanding your tax obligations and legal responsibilities

As a taxpayer, you have a legal responsibility to accurately report your income, claim only allowable deductions and credits, and pay the taxes you owe on time. Failure to do so, whether by honest mistake or deliberate evasion, can result in penalties and legal consequences.

It’s important to understand your specific tax obligations, which can vary depending on your individual circumstances. For example, if you’re self-employed, you’ll need to file a self assessment tax return each year and pay income tax and National Insurance contributions on your profits.

Staying up-to-date with changes in tax legislation

Tax laws and regulations are subject to frequent change, often on an annual basis. Staying on top of these changes is crucial to effective tax planning and avoiding pitfalls.

Taxpayers should regularly review government publications and news sources for tax updates. Working with a tax professional who stays current on legislative changes is also advisable.

For example, in recent years, there have been significant changes to the rules around off-payroll working (IR35) and the loan charge, which have had a major impact on contractors and freelancers.

IR35 explained: What Is IR35? A Comprehensive Guide for Freelancers and Contractors

The role of general anti-abuse rules in combating tax avoidance

The UK has a General Anti-Abuse Rule (GAAR) aimed at counteracting tax advantages arising from abusive tax arrangements. The GAAR applies to arrangements that are contrived, abnormal, or lacking commercial substance, and enables HMRC to pursue taxpayers who engage in such schemes.

The GAAR helps draw a line between acceptable tax planning and abusive tax avoidance. It’s designed to tackle aggressive tax avoidance schemes that comply with the letter, but not the spirit, of the law.

If HMRC believes that an arrangement is abusive, they can apply the GAAR and counteract the tax advantage. This can result in additional taxes, penalties, and interest becoming due.

Case studies: real-life examples of tax avoidance and their outcomes

While the line between tax planning and tax avoidance can sometimes seem blurry, real-life case studies illustrate the risks and consequences of crossing into avoidance territory.

From the loan charge controversy to employee benefit trust schemes, these examples show how even seemingly legitimate arrangements can fall foul of the rules.

The loan charge controversy and its impact on taxpayers

The loan charge was introduced to tackle disguised remuneration schemes where workers were paid via loans that were never intended to be repaid, avoiding income tax and National Insurance contributions.

The charge applied retrospectively to loans made since 1999, leading to many facing substantial unexpected tax bills. After much controversy, the rules were revised in 2020 to reduce the retrospective impact.

However, many taxpayers still faced significant liabilities and some were pushed into bankruptcy. The controversy highlighted the importance of understanding the risks of tax avoidance schemes, even those that may have been considered acceptable in the past.

Employee benefit trust schemes and their consequences

Employee Benefit Trusts (EBTs) were used by some companies to avoid tax by paying employees in loans from offshore trusts, rather than as taxable salaries.

Rangers Football Club’s use of EBTs led to a prolonged dispute with HMRC, which went to the Supreme Court. In 2017, the court ruled that the payments should be taxable as earnings, setting a precedent for other EBT cases.

Many companies and individuals who used EBTs have since faced significant tax bills and penalties. The case underlined the risks of using artificial schemes to avoid tax, even if they were once considered legitimate tax planning.

Navigating tax disputes and payment notices

When HMRC suspects tax avoidance, they may issue an Accelerated Payment Notice (APN) requiring upfront payment of disputed tax within 90 days, or a Follower Notice if the scheme is similar to one that has been defeated in court.

Taxpayers have limited appeal rights with APNs. If an avoidance scheme is defeated, taxpayers may face penalties up to 100% of the tax due.

Navigating tax disputes can be stressful and costly. Seeking professional advice early on can help manage the process and potentially reach a settlement with HMRC.

Making informed decisions: when to seek professional tax advice

With the complexity of tax law and the risks of getting it wrong, knowing when to seek professional advice is crucial. But how do you know when it’s time to call in the experts?

And once you’ve decided to seek advice, how do you choose the right tax professional for your needs? Here are some key considerations.

Identifying situations where professional tax advice is crucial

There are many situations where seeking professional tax advice is strongly recommended, such as starting a business, engaging in complex transactions, working overseas, receiving an inheritance, or being contacted by HMRC.

Whenever there is uncertainty about tax implications or a risk of non-compliance, consulting a professional is prudent. It’s better to get advice upfront than to face the consequences of getting it wrong.

For example, if you’re considering investing in a tax scheme or offshore arrangement, getting a second opinion from an independent tax expert can help you assess the risks and legitimacy of the scheme.

Choosing the right tax professional for your needs

When selecting a tax advisor, consider their qualifications, experience, specialties, and professional reputation. Look for advisors who are chartered tax advisers, certified accountants, or tax attorneys.

Ask about their experience with situations similar to yours. For example, if you’re a contractor, look for an advisor who specializes in IR35 and self-employment taxes. Beware of advisors who promote aggressive schemes or promise results that seem too good to be true. Sleek offers assistance from expert tax professionals who will give you an honest assessment of your situation and the risks and benefits of different options.

The benefits of proactive tax planning and advice

Proactive tax planning with the guidance of a qualified professional can provide significant benefits, including minimising taxes owed, maximising allowable deductions and credits, optimizing business structure, avoiding costly mistakes and penalties, and achieving greater financial efficiency.

Making tax planning reviews can identify opportunities and ensure ongoing compliance. By taking a proactive approach, you can have peace of mind that your tax affairs are in order and that you’re making informed decisions about your finances.

In the long run, investing in a professional tax expert from Sleek can save you money, time, and stress. Their expertise and friendly guidance can help you navigate the complex world of tax with confidence.

Conclusion

Tax avoidance vs tax planning – now you know the difference. To avoid paying tax is like playing with fire. It might seem tempting, but it’s illegal and can burn you in the end. Tax planning, on the other hand, is like a cool drink on a hot day. It’s refreshing, legal, and can save you a bundle.

A savvy tax expert by your side can make navigating those complex tax codes feel like a breeze. They can help you create a personalized tax plan that minimizes your liability while keeping you compliant.

If you need professional assistance with your tax compliance, explore Sleek – a reliable and affordable platform offering services which range from business registration, accounting, tax compliance, and more. This B2B platform tailors their services to suit the requirements of small and emerging businesses.

FAQs in relation to tax avoidance vs tax planning

Is tax planning the same as tax avoidance?

No, they’re different. Tax planning is working within the law to reduce your bill; avoidance involves bending rules to pay less.

What is an example of tax avoidance?

Using loopholes to shift profits offshore reduces taxes owed—classic avoidance behaviour that’s frowned upon but often legal.

What's the difference between tax evasion and tax avoidance?

Evasion is illegal hiding of income. Avoidance uses gaps in laws to lower taxes without breaking them outright.

What is the difference between tax efficiency and tax avoidance?

Tax efficiency means smartly managing finances through financial schemes or any other acceptable practice for minimum legal tax payment. Avoidance seeks loopholes for paying even less, skirting legality.